25+ Back end ratio calculator

Lenders Lender A lender is defined as a business or financial institution that extends credit to. This means you dont only include debt repayments for housing but also look at.

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Following the formula provided above back-end ratio total debt paymentsmonthly.

. Thus the total debt payments for Sam are 1600 per month. Monthly Mortgage Obligation Gross Monthly Income. They can also be written as 1 to 2 or as a fraction ½.

You derive your backend DTI ratio by dividing your monthly housing expenses and other debt obligations by your monthly gross income. The ratio represents the number that needs to be multiplied by the denominator in order to yield the numerator. Also calculated is the new gearing you would need in order to return.

Use our gear ratio calculator to find the effective gear ratio your vehicle will have with a new tire size. The back-end ratio also known as the debt-to-income ratio is a ratio that indicates what portion of a persons monthly income goes toward paying debts. In that same scenario if your total debt payments are 1800 1000 for mortgage 350 auto loan 300 credit cards 150.

Here is an example of the back. If your total mortgage payment is 1000 your front-end ratio is 25. Back End Mortgage Ratio Total Monthly Expenses Gross Monthly Income 100.

The total is your back end DTI ratio. Multiply the total from step 2 by 100. Its used to determine if youre able to qualify for a mortgage.

Use this worksheet to figure your debt to income ratio. In this case ½. New Ratio Needed.

Generally speaking a debt ratio greater than or equal to 40 indicates you are not a good. The back-end ratio is a measure that signifies the portion of monthly income used to settle debts. The back end ratio also includes the proposed mortgage payment with taxes insurance PMI etc.

This is calculated by taking the total monthly housing costs by income before tax. The lower the DTI the better your odds are for being approved for new credit. Calculate Your Debt to Income Ratio.

To get the percentage you multiply the. Normally the front-end DTIback-end DTI limits for conventional financing are 2836 the Federal Housing Administration FHA limits are 3143 and the VA loan limits are 4141. Since monthly mortgage obligation PITI equals monthly.

It can be expressed using the formula below.

Loss Ratio Formula Calculator Example With Excel Template

Unlock Your Macro Type Identify Your True Body Type Understand Your Carb Tolerance Accelerate Fat Loss Hronec Christine 9780358576624 Amazon Com Books

How I Earn Over 10 Passive Income With P2p Lending

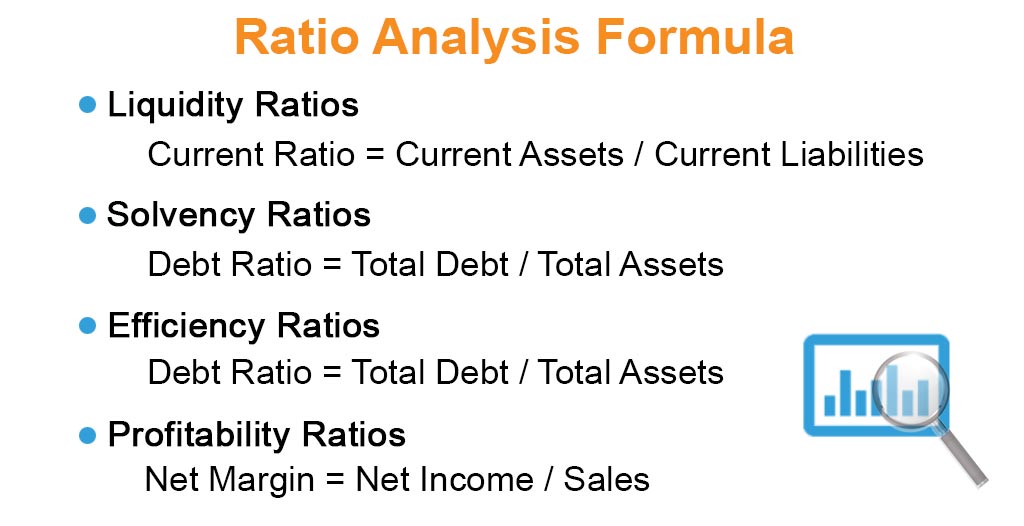

Ratio Analysis Formula Calculator Example With Excel Template

Gear Ratio Calculation A 100 Tooth Gear Drives A 25 Tooth Gear Calculate The Gear Ratio Of The Mesh Mechanical Engineering Engineering Mechanical Gears

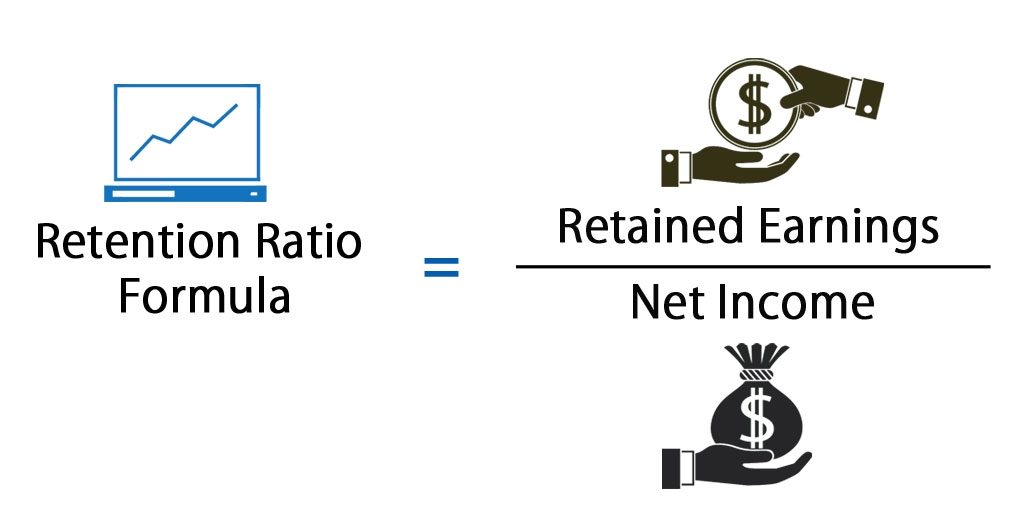

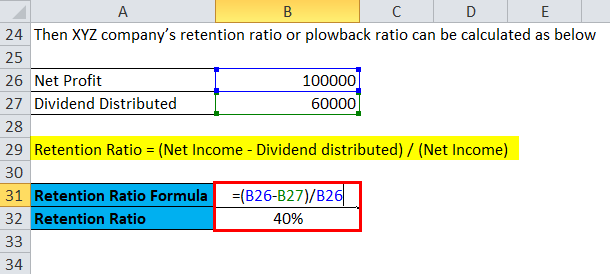

Retention Ratio Formula Calculator Excel Template

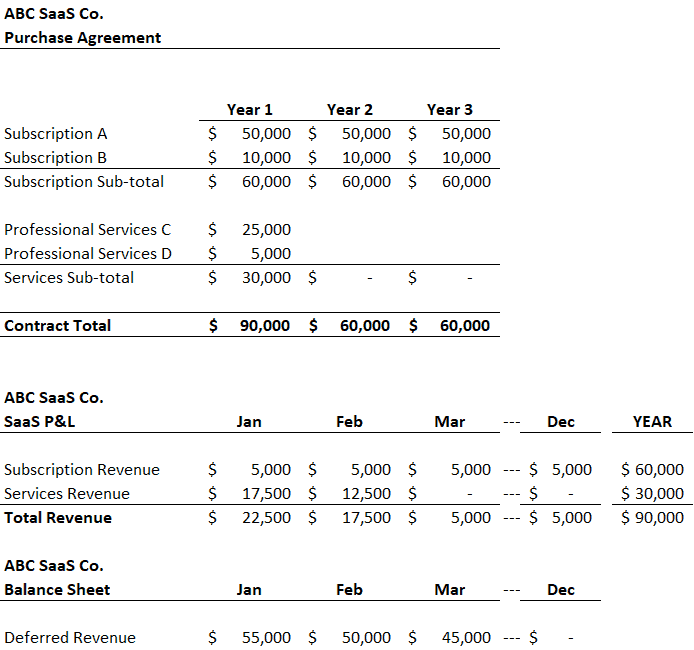

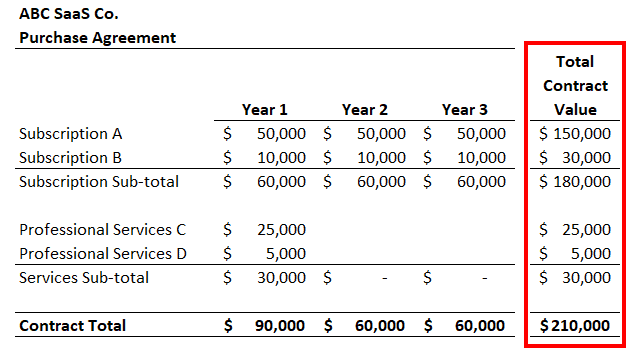

Bookings Vs Invoicing Vs Revenue The Saas Revenue Cycle Explained The Saas Cfo

Measure Your Financial Security By Calculating Your Debt To Cash Ratio

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Blog Finding Financial Freedom

What Do You Think The Best Gear Ratio For Me Is Bike Forums

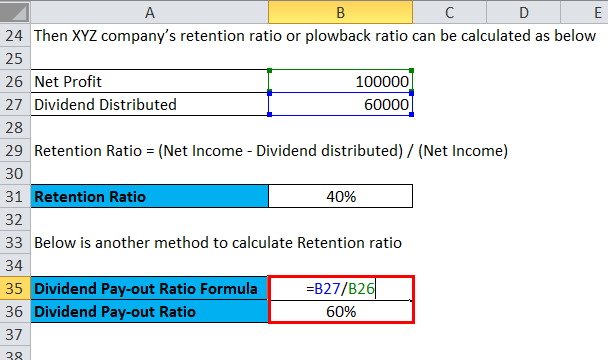

Retention Ratio Formula Calculator Excel Template

Measure Your Financial Security By Calculating Your Debt To Cash Ratio

Debt To Income Ratio Formula Calculator Excel Template

Bookings Vs Invoicing Vs Revenue The Saas Revenue Cycle Explained The Saas Cfo

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

Retention Ratio Formula Calculator Excel Template