Irs w4 estimator

Figure out which withholdings work best. Calculate your tax refund for free.

How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert

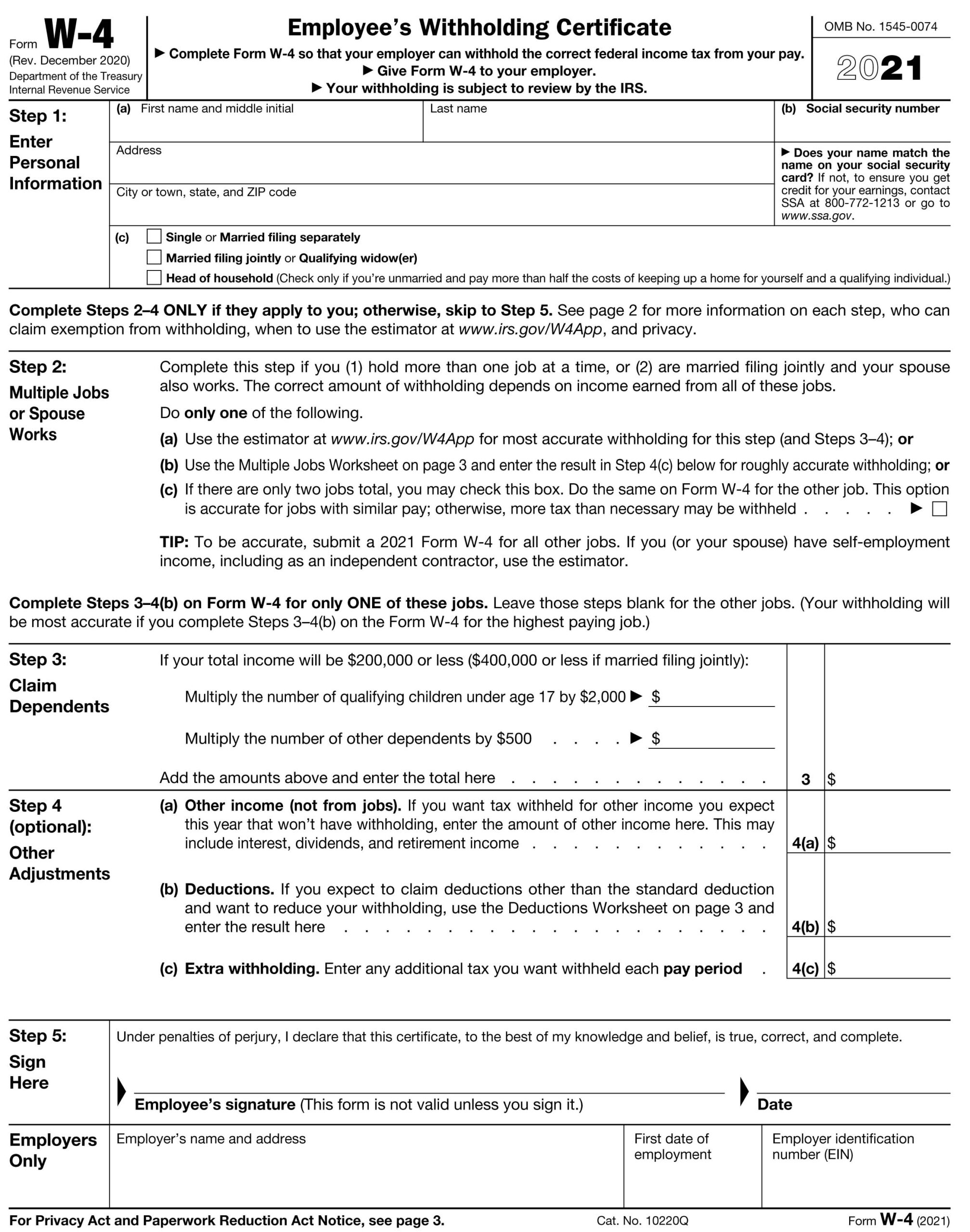

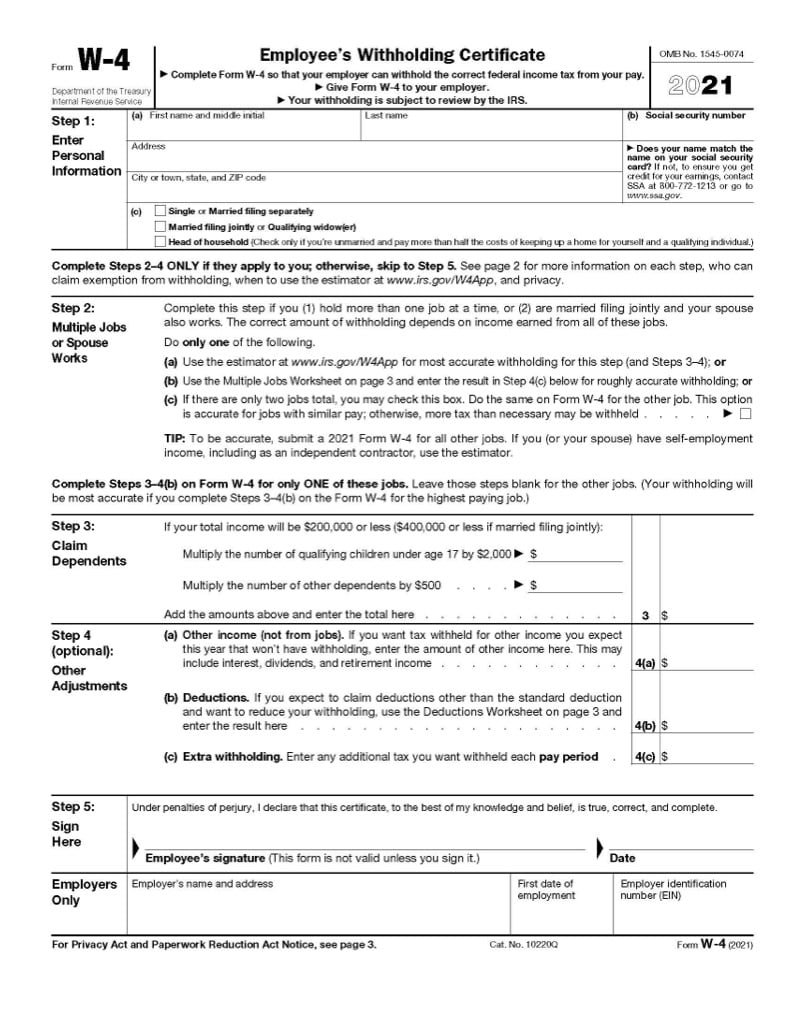

Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime.

. To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator. The calculator helps you determine the recommended. It will be updated with 2023 tax year data as soon the data is available from the IRS.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. This Tax Return and. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Well calculate the difference on what you owe and what youve paid. Our free W4 calculator allows you to enter your tax information and adjust your paycheck. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Figure out which withholdings work best. You must understand the. Premium federal filing is 100 free with no upgrades.

Ad Free tax calculator for simple and complex returns. The IRS W-4 calculator assists you in determining the suggested withholding amount as. 250 and subtract the refund adjust amount from that.

They should estimate their tax withholding with the new Form W-4P. Guaranteed maximum tax refund. They should use Notice 1392 Supplement Form W-4 Instructions for.

Use our W-4 calculator. If youve already paid more than what you will owe in taxes youll likely receive a refund. The IRS W-4 calculator helps you with the following.

They have nonresident alien status. The calculator helps you determine the recommended. Prepare and e-File your.

If you are employed and the Tax Withholding Estimator indicates you will have too much tax withheld you may have your federal withholding decreased by preparing a new Form. 250 minus 200 50. Then look at your last paychecks tax withholding amount eg.

Up to 10 cash back Maximize your refund with TaxActs Refund Booster. This Tax Return and Refund Estimator is currently based on 2022 tax tables. See your tax refund estimate.

That result is the tax withholding amount. Prepare and e-File your. The IRS W-4 calculator assists you in determining the suggested withholding amount as well as any additional withholding that should be reported on your W-4 form.

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

Tax Forms Easy Tax Store

The New Irs Form W 4 Has Many Scratching Their Heads Here S What You Should Know Komo

Irs Witholding Calculator

Form W 4 Employee S Withholding Certificate 2021 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Internal Revenue Service

Understanding Your W 4 Mission Money

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

Irs Improves Online Tax Withholding Calculator

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

New Form W 4 For 2020 Nmra

What Do You Do With A W4 Tax Form Jackson Hewitt

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

How To Fill Out The W 4 Form New For 2020 Smartasset Federal Income Tax Form Income Tax

How To Fill Out Irs Form W 4 2020 Married Filing Jointly

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

How To Fill Out The W 4 Form New For 2020 Smartasset Federal Income Tax Form Income Tax

What Is Irs Form W 4